Russia - Written by Barry & Richard on Tuesday, March 22, 2011 3:38 - 0 Comments

Richard Alderman: 3 reasons why compliance is good for Russian companies

Last week Richard Alderman visited Russia in a series of speaking engagements.

Last week Richard Alderman visited Russia in a series of speaking engagements.

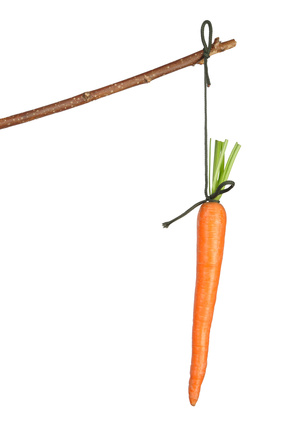

The stick

He emphasised once again the intention of the SFO to prosecute companies who compete unfairly against ethical UK corporates using bribery.

This is the stick. Something we have written about on numerous occasions.

When it comes to overseas corporates much of the stick relies upon (1) the ability to demonstrate that the overseas corporate carries on business in the UK. (Mr. Alderman did not address the current rumours circulating in the media relating to a potential weakening of this test in the now fabled guidance) and (2) the ability to enforce.

In spite of the rhetoric some question the ability to enforce in faraway jurisdictions like Russia.

The carrot

However, Mr. Alderman also spoke of the carrot and gave three commercial reasons why an overseas company should think twice before engaging in corruption. These may turn out to have more power than the stick.

Now you see it, now you don’t

First Mr. Alderman gave the example of a busted deal.

“Assume that you are the owner of a very successful Russian company that does business in a number of different jurisdictions. At some time you might receive an approach from a corporation, let us say based in the US or the UK, talking about a merger or indeed buying you out. The sum of money that is talked about is very large and is one that you would certainly want to accept. However, the offer is provisional upon satisfactory due diligence.

The US or UK corporation calls in well known enquiry agents to have a detailed look at what your Russian company has been doing in a number of jurisdictions. They will look at what the company has done, what your agents have done, your sub-contractors and anybody else providing services to you. They may find some doubtful dealings and potential corruption issues. That is then reported back to the US or UK corporation.

What is the result? Well the buying organisation might just walk away. Alternatively, they return with you to the negotiating table to talk about a substantial reduction in costs. This is because they will be taking on your potential liabilities relating to corruption and would have to get involved themselves in spending a considerable amount of money in sorting out these issues. The deal that looked as though it was going to make you incredibly rich has now disappeared.”

We think that this will become an increasingly likely scenario as the profile of anti-corruption increases. We are aware of examples of deals involving US buyers falling apart on the back of corruption concerns and a recent Deloitte survey makes the same point. We see no reason why this should not extend to UK companies against a back drop of increasingly aggressive UK enforcement and the Bribery Act.

Looking for trouble

Second Mr. Alderman spoke of more and more big corporations asking as part of their due diligence when choosing trading partners:

“whether those companies have ever been the subject of an investigation relating to corruption. Not a conviction. But simply an investigation. If you have to answer that there has been a corruption investigation anywhere in respect of the company you are a member of, then it is highly likely that the corporation awarding the contract will look elsewhere.”

We have seen a steady increase in the levels of due diligence imposed by corporates when entering into arrangements with trading partners. If there is or has been an investigation or there are corruption allegations swirling around we have seen a distinct cooling in the attitude of partners, customers and suppliers.

Transparency

Thirdly, Mr. Alderman referred to the current political instability in Africa. He explained that:

“it seems to me that dealings between companies and states and politicians are going to become a lot more transparent in the next few years. As I look at the events that have been happening in various countries in North Africa, I see that one of the complaints of the protesters is corruption. My view is that we are likely to hear far more in future about this corruption and how foreign companies actually obtained contracts. I am certainly looking out for this information and I have no doubt whatsoever that my counterparts in other jurisdictions are doing so as well. I expect it to be a very important source of work for the Serious Fraud Office in the coming years.”

We wrote recently about the risks regime change in North Africa posed to corporates.

Russia has traditionally been regarded as a black spot when it comes to corruption nestling as it does at 154th place on the Transparency International Corruption Perception Index. What, you might think, does a Russian company care about anti-corruption. Dmitry Medvedev has been pushing anti-corruption policies albeit with limited success.

In 2009 the Russian Federation made a formal request to accede to the OECD Anti-Bribery Convention and to become a member of the Working Group on Bribery. In June 2010 the Working Group invited Russia to take three legislative steps as a priority. These concerned an offence of bribery of foreign public officials, an increase in the statute of limitations and an increase in sanctions.

The draft legislation is proceeding through the Duma at present. Perhaps this will be the fourth reason?