Bribery Act & Proceeds of Crime - Written by Barry & Richard on Sunday, September 25, 2011 23:49 - 0 Comments

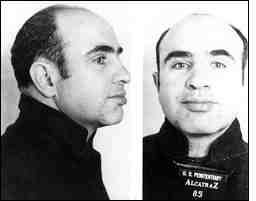

Al Capone & the Bribery Act

Al Capone was indicted in 1931 for income tax evasion and failing to file tax returns.

Al Capone was indicted in 1931 for income tax evasion and failing to file tax returns.

Who would have thought that America’s infamous gangster would be taken down by Frank Wilson, an investigator with the IRS. Capone received 11 years for Revenue offences and never recovered his powerful position after his incarceration. After his release in 1939 Capone lived in seclusion until his death 8 years later in 1947.

Recent remarks from the Home Office in the UK, directed at how to disrupt organised crime, stressed that action would be taken to prosecute minor offences in order to hamper the operations of criminal enterprises.

Richard Alderman’s speech, at the 29th International Symposium on Economic Crime, should be no surprise. The use of tax violations in the context of bribery enforcement fits within the category of clever enforcement.

The idea that the accounting records of companies are to be checked to see how corrupt payments have been categorised, specifically, whether there have been claims for tax deduction is inevitable.

We have written many times of the common features of the US approach to enforcing ant-corruption measures and the UK’s recent approach.

The FCPA ‘Books and Records’ sections are a mighty weapon in the hands of the SEC. In the US it has long been the case that ‘corrupt payments’ have run into massive difficulty through the application of the requirements which demand they be identified and not claimed as a business expense.

The Bribery Act was designed to fit within the web of existing legislation.

The Bribery Act does not contain chapters relating to the books and records of companies. We have stressed the inter-relationship with POCA both parts 4 and 5.

It is clear that the Companies Act, Financial Services and Markets Act, Income and Corporation Taxes Act , to name but three others (there are more), are going to be required reading for general Counsel and the Board going forward.

There is a common approach developing between the UK and the US.

But as we said earlier this month: There really is ‘nothing new under the sun’.