News & what's on - Written by Barry & Richard on Thursday, September 8, 2011 22:43 - 0 Comments

Common sense prevails: Competitors claim bribery – regulators say no

The SFO have said this about incentives:

The SFO have said this about incentives:

“Our view is that they need to be transparent to all the parties and that the company that is ultimately funding the incentive payments needs to be sure that these are genuine incentive payments going to individuals and are not being used in order to provide a way of making bribes to third parties. We encourage a senior officer of the ultimate paying company to have responsibility for this and to make sure they are content that these payments are going for proper purposes.

We do not have a problem about all of this, although I should add that we have indicated some disquiet when the payments are not actually known to the employer of the individual receiving the payments. This seems to us unsatisfactory for all sorts of reasons and we have encouraged the company to think about this.”

Yet they continue to create debate.

Mortgage Strategy recently published an article relating to an incentive offered by Bank of Ireland to certain of its customers to find alternative mortgage finance using a specific broker, London and Country. If they do so Bank of Ireland announced that it would pay the customer £1000. A Bank of Ireland spokesperson reportedly put it this way:

“Bank of Ireland UK announced that it would seek to deleverage its intermediary-sourced mortgage book in the UK in January 2009. The pilot currently being communicated to a select group of customers is part of this.”

Mortgage brokers, excluding London and Country cried foul asserting that the deal was a breach of the Bribery Act as well as FSA rules.

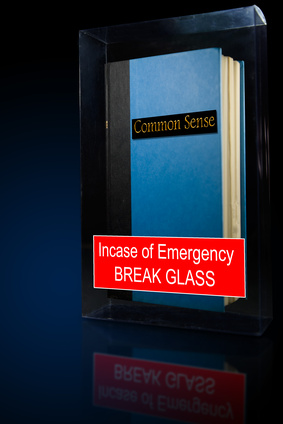

Fortunately common sense prevailed.

The FSA reportedly said: “We cannot comment on individual firms but there is a clear difference between a bribe and an incentive. If an offer is transparent to consumers and commercially justifiable, it is not a bribe.“

A Ministry of Justice spokesman was even more brusque and reportedly said: “This has nothing to do with the Bribery Act.”

The example demonstrates two points nicely.

First, commercial competitors will not shy away from claiming that an offer is a violation of the Bribery Act.

Second, incentives are not necessarily bribes. Much depends on context and transparency. The FSA’s statement follows the SFO logic on the topic.