Bribery Act & Proceeds of Crime - Written by Barry & Richard on Sunday, May 27, 2012 21:58 - 0 Comments

Collapse in Serious Fraud Office raids highlights need for action

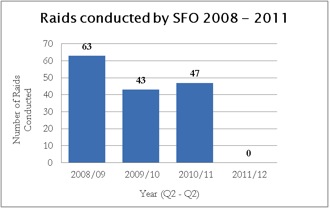

According to statistics obtained by international law firm Pinsent Masons the Serious Fraud Office (SFO) did not undertake a single raid in the last year (to March 31 2012).

According to statistics obtained by international law firm Pinsent Masons the Serious Fraud Office (SFO) did not undertake a single raid in the last year (to March 31 2012).In response to a Freedom of Information request Pinsent Masons was told that between 2008 and 2010 the SFO conducted between 43 – 63 raids a year. However, after 16 raids conducted in the first quarter of 2011 the SFO did not lead any raids in the next 12 months.

Empty threats

Over the weekend the SFO told the BBC that five raids were conducted in March which were not included in the reply to Pinsent Masons FOI request.

Yet, even taking into account the additional five raids the statistics show a total collapse in the number of SFO raids.

This contrasts with the SFO’s public threats. Last October the former Director of the SFO threatened corporations involved in bribery that:

“it may be that…the first that the corporation knows about the SFO’s interest is when we arrive early in the morning equipped with search warrants and arrest powers.…It is going to happen.”

Out of step

Other regulators and prosecutors have taken a much more aggressive approach.

The government have announced that they want a five fold increase in HMRC prosecutions. Likewise, dawn raids by the Financial Services Authority soared during the financial crisis peaking in 2009 with 37. Last year the FSA conducted 21 dawn raids – over four times more than the SFO on the SFO’s BBC numbers.

Justice must be done & seen to be done

The figures indicate that the SFO has been gun shy following its much criticised dawn raids on the properties of businessmen Vincent and Robert Tchenguiz in March 2011.

The new Director of the SFO David Green CB QC has laid out a firm plan to restore confidence in the SFO. It is critical that he does and is seen to do so.

The SFO needs to publicly wield the stick and deliver on its threats to investigate and prosecute serious fraud that threatens to damage UK PLC and undermine confidence in UK markets.

The SFO’s decision to rein back on raids during the past year is a missed opportunity against a backdrop of the cost of fraud to the UK economy currently estimated at around £73 billion per year (source: National Fraud Authority).

At the same time ethical companies who do their best but suffer at the hands of a rogue employee need to be shown the carrot. They must not be unfairly penalised.

Government & judicial support for the SFO remains strong

With criticism of legacy investigations combining with questions about the future of the SFO last week support for the Serious Fraud Office came from an unlikely source.

In the High Court Lord Justice Thomas responsible for some of the most recent withering criticism of the SFO said it was important that the SFO is‘properly financed’ so it can ‘so it can do things with the clarity with which they should be done’.

Asked what the government should think about giving the SFO more funding Lord Justice Thomas said: “I’m sure they would realise that that is also essential from their perspective regarding the City of London.”

Money no object

The new Director of the SFO has said that he is “all in favour of prosecuting authorities being funded, to a greater or lesser extent, by money taken from criminals” . The statement may be a reference to the fact that the SFO’s dwindling budget may be less of an issue than some might think. As Lord Justice Thomas has previously pointed out:

“Under what is somewhat surprisingly called an “incentive scheme”, the proceeds obtained from a confiscation order are, once collected by the Ministry of Justice, distributed to the Home Office in accordance with an agreed protocol with HM Treasury. That confiscation income is then distributed by the Home Office who retain 50% passing 18.75% to the prosecuting authority and 18.75% to the investigating authority and 12.5% to Her Majesty’s Court Service.

As the Serious Fraud Office is both the investigating and prosecuting authority, 37.5% of the confiscation amount in this case would go to the SFO, it would form part of the income of the Office.”

Effective use of this scheme in top end fraud and corruption cases could significantly swell SFO coffers.

Last week there was more good news for the SFO from government too.

The Solicitor General confirmed government support for the SFO in parliamentary questions. Conservative MP Robert Buckland asked “does not recent adverse publicity about the incompetence of the Serious Fraud Office call into question the integrity of fraud investigation in our country? Is it not a matter of utmost importance that we should address urgently?”

Edward Garnier, the Solicitor General, replied “…with the greatest respect, I do not entirely accept the premise of all my hon. Friend’s question, I can assure him that the Serious Fraud Office is pursuing investigations and prosecutions with competence and vigour.” Answering another question from Labour MP Graham Morris about the future of the SFO the Solicitor General confirmed the “The SFO has a bright future.”…with “a remit to deal with high-end fraud, international fraud and corruption”.

Prediction

Instead of dwindling resources hampering the SFO’s work, in fact the SFO cannot afford not to get out the carrot and the stick. If it doesn’t it will be widely seen as the boy who cried wolf.

Expect more dawn raids from the SFO under the direction of Mr. Green.