All you need to know about self reporting, Bribery Act & Proceeds of Crime - Written by Barry & Richard on Monday, January 14, 2013 2:22 - 2 Comments

Self Reporting to SFO almost doubles in a year

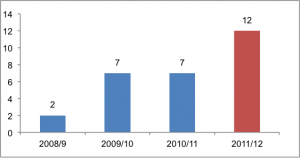

The number of businesses self-reporting white collar crime to the Serious Fraud Office (SFO) has almost doubled in the last year, jumping from 7 reports in 2010-2011 to 12 in 2011-2012*. [Table left shows increase in self reporting since 2008/9]

The number of businesses self-reporting white collar crime to the Serious Fraud Office (SFO) has almost doubled in the last year, jumping from 7 reports in 2010-2011 to 12 in 2011-2012*. [Table left shows increase in self reporting since 2008/9]

Recently, Rolls-Royce became the latest major corporate to self-report to the SFO, following a request by the SFO for information relating to its operations in the Far East.

Opinion

The July 2011 introduction of the Bribery Act is a key reason behind the spike, with corporates increasingly concerned about the consequences of not coming clean to the Serious Fraud Office and increased awareness of bribery concerns.

While self-reporting won’t let a corporate avoid prosecution it could help reduce the risk of receiving the most severe punishments. Corporates at least have a chance of limiting the damage if they’re up front with the SFO.

Burying its head in the sand is not a long-term solution for a corporate that suspects wrongdoing. The SFO has plenty of sources of information at its disposal and is investing in intelligence, so the net can close in very quickly, with or without a company’s co-operation.

The risk of being ‘caught out’ is heightened by the high level of whistleblowing that takes place in the UK.

Between November 2011 and 2012, the SFO received 3,265 letters, emails, or phonecalls to report financial crime, according to figures released by the solicitor-general.

Likewise the US Securities and Exchange Commission figures show that the UK was the most common source of non-US financial crime tip-offs in the 12 months to 30 September 2012, representing 23% of non-US leads (74 out of 324 tip-offs).

Corporates need to remember that the SFO might have information about wrongdoing in a corporate other than evidence from a self-report. The whistleblowing culture is alive and well, so corporates should not assume that the SFO doesn’t know or will not find out about something if they haven’t yet reported it. Rolls Royce appears to be a good example of what can happen.

*Year end 31 March

2 Comments

Self Reporting to SFO almost doubles in a year – thebriberyact.com

High Tide: From Cyprus Fights Back to Adoption Ban Protests ‹ Cyprus Today

[…] admitting guilt to a U.K. Serious Fraud Office scarcely doubled in a past mercantile year. More here. (Financial Times sub req, […]

[…] via Self Reporting to SFO almost doubles in a year – thebriberyact.com. […]